I have heard the notion of Google being analogous to a bank for a number of years. Recently, Jim Sterne also referred to this bank analogy while we were discussing online privacy at the Orion Analytics panel of SES London (2009). So I wanted share and expand upon this discussion.

I have heard the notion of Google being analogous to a bank for a number of years. Recently, Jim Sterne also referred to this bank analogy while we were discussing online privacy at the Orion Analytics panel of SES London (2009). So I wanted share and expand upon this discussion.

Please take a moment to read my disclaimer before continuing – that is, the views express on this site are entirely my own and do not represent those of my employer.

Is Google entering into online banking?

In this respect no (I am not considering Checkout here). What I mean by being analogous to a bank, is in the way that data itself has become “currency”. Information has always been valuable – no one likes to be the last to know, and being the first to know gives you a competitive advantage. So whether online or not, the storage and access of data, its security and privacy, is of paramount importance to anyone who hands over information to be stored by a third party.

That is pretty much everybody with Internet access and includes individuals, small businesses and corporations alike. Google occupying such a strong online position – the conduit for many people to find information, products, businesses etc. obviously has an important role to play when it come to data privacy and security.

It’s important that privacy and security have no intrinsic value

A key factor that makes a good, secure and private data storage system, is the strict application of a one size fits all privacy and security policy. That is, regardless of whether you are one of the worlds largest brands spending millions of dollars on operations, manufacturing or marketing, or a small company selling your handicrafts locally – your data should be treated with equal importance.

As an example, imagine if a search engine or bank provided a greater level of security and privacy to large advertisers rather than smaller advertisers (or to those that saved more than others). Even the perception of such a practice would be disastrous for the organisation in charge of protecting your data “currency”. You of course want bullet proof controls whether you save $1 or $100 million dollars. That is how the banking system works and is also how Google operates with respect to handling all visitor and customer data.

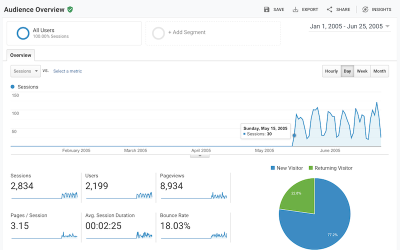

Who sees my Google Analytics data within Google?

“Does it matter?” was the response from Jim Sterne on the SES panel. “Seriously, do you worry who at your bank knows how much money you have? Google has way too much at stake to allow misuse of your data.” If you trust the bank to store or loan you money, then by default you trust the procedures, access control systems and employees of that bank to handle your finances appropriately.

Would you really expect the bank to produce a Terms of Service that explicitly names individuals that can view your transactions data? No bank is going to do that and similarly no search engine or hosted analytics provider should do either, for the simple reason that it is unworkable. And if it is unworkable, then inevitably the system will break down and that poses a greater risk to security and privacy.

If you really don’t feel comfortable sharing your web visitor data (and that can be for perfectly valid reasons), then bring your data in-house. That is, run server-side web analytics tools such as Urchin and take responsibility for the storage and processing of the data yourself.

How does using Google Analytics effect my AdWords prices?

It doesn’t. Why? Because it is the market that determines the price of your bids in the open AdWords auction system, not Google itself. Ian Thomas (Microsoft), challenged this by making the point that Google uses the Quality Score system. This system effectively scans your landing pages to ensure a good match between them and your ad copy. The thinking is that an ad mentioning terms that cannot be found on your landing pages is not a good experience for potential visitors. Hence, if this was the case, such ads would result in a higher cost to the advertiser than those with a better quality score*.

The AdWords Quality Score system is so effective at improving the user experience (by encouraging marketers to improve their ads and landing pages and therefore reduce their cost), that other suppliers have followed suit – for example, Microsoft adCenter and Yahoo! Search Marketing. I don’t know the details of those systems, but the important point is that it is not the ad serving platform determining the bid price. Yes, it is measuring it, but it is the market (advertising competitors and end-users) that ultimately determine the bid price you pay.

*Note: Many other factors are also taken into account when calculating Quality Scores. For example, historical click-throughs – firstly do visitors click on your ads compared to your competitors, and if so, do visitors click on your ad and then within a short space of time return back to the Google results to click on other ads? Such behaviour would also indicate a poor user experience.

Do you fear Google? Is sharing visitor data with Google such a bad thing? Clearly if you are a Microsoft, E-bay, Amazon, Expedia etc., I don’t expect you to use Google Analytics. But what about you? Please share your views with me (not Google!) via a comment.

Ok so they are a monopoly

I guess I am G basher but not without personal reason – they entered the WebAnalytics market and offered what my company had been doing for many years free of charge (this is what monopolies can do).

I am getting over it now as I managed to sell WebtraffIQ.

I now use GA on daily basis and I am even developing a few APIs for it. So, onwards and upwards 🙂

Marcos

Eric: Thanks for the well thought out comments. I agree about the conflict of banks being investment houses and the mess they got themselves into. However I still feel that my personal privacy and data security are safe – its their ability to invest my money wisely that I question/fear.

Marcos: For G’s competition, I would say Yahoo in the UK/US, Baidu in China, Yandex and Mail.ru in Russia, Makoob in the Middle East, Naver in Korea and Yahoo throughout most of Asia etc. Microsoft search and advertising solutions are actually very small in terms of market share – about the same as for Ask.com. The point is, there are (and has been) plenty of competition. Any one remember Alta Vista, Infoseek, Lycos or Excite?

All of these are free to use – there is no compensation from Microsoft et al if suddenly people can no longer find you on Bing or Live.

As for exit strategies – I can’t speak for Larry or Sergey, but I don’t think money is their objective any more (I am not sure it ever was).

BTW, Marcos – you are a well known G basher and you know it 🙂

Not Google bashing but there are couple of points I would like to pick up on…

‘A unique feature of the web, is that the competition is only one click away. There is no contract or tie with Google products that forces people to use them. If they did not have good, trust worthy products, Google’s business model would collapse – and rapidly. That’s why there is no conflict of interest for G.’

1.) The competition is just Microsoft this makes this particular business area a duopoly, this is not good so much so that there are strict legal regulations governing duopolies which don’t seem to apply online?

2.) Having no contract is at the crux of the privacy and trust discussion. ‘If’ G did start passing the data is holds to third parties there would be no damages no compensation and no reparation.

3.) G is a business in business to make money. Most if not all businesses have exit strategies which usually consist of full or partial trade sale. Quite sure that holding company data is a big asset on the books.

R

Marcos Richardson

Head of SEO & Analytics

I have heard of Yahoo’s Analytics tool. I have the same views on it. Still conflict of interest. It’s why, up until a few presidential terms ago, banks and investment houses had to be separated. Perception of conflict of interest.. And look where that ended up after letting up on those rules.

I most assuredly am not on the right wing side of this discussion. I do almost everything online. I try to pay attention to security and privacy, but I refuse to live my life in fear. I listen to all sides of the discussion, and form my opinions after personal reflection. I’ve read numerous articles on the potential issues with a search engine pricing ads based on conversion metrics obtained from clients analytics data. It is a very real possibility, and would be very difficult to prove or even be aware of.

That said, I’m not a GA hater. I regularly implement it for clients. I see your points, but maintain my points are valid as well. I find that anyone with a strong opinion probably has underlying motivations that aren’t being presented.

Quick note about trusting banks…

I live in Canada and our banking system here has a very strong foundation. Customer balances are insured & protected. So the bank analogy might be more relevant up north… lol 😉

Thoroughly enjoyed reading this article Brian.

When it comes to privacy, I tend to imagine the analogy of a “political spectrum”. Some people gravitate towards the left, others to the right, and some stay centered.

Building on your “Google is a bank” analogy, there are some who are extreme in their privacy concerns and do not trust Google for the security of their data i.e. they will never bank online. While others put their blind trust into Google and feel comfortable working with them in all facets i.e. they will bank, pay bills, and manage their finances completely online.

What it comes down to is the “privacy spectrum” and what visitors & users ideologically believe in. Are you right-wing when it comes to privacy (do not trust cookies, internet firms, tracking tools) OR are you left-wing? (completely trust the internet for tracking behavior in order to receive a more enhanced experience).

And still, some may be centered with their approach (trust some sites and applications after due diligence, but mistrust others that don’t meet a certain criteria).

No visitor or internet user is the same. Each person surfs the net and interacts with the web in a unique and personal way. Similar to all democracies, each citizen has a right to vote on their privacy. Question is, which party runs the best campaign to win your trust?

Personally, I trust Google just like I trust my bank. They have my vote of confidence.

Ali: I like your political analogy. Certainly places with “centred” political views are the most successful/desirable places to live and work. Of course, I would never advocate blindly trusting any company – it comes down to reputation, credibility and track record, and taking a balance view on these. I certainly do not think Google are perfect – I worked there, and worked with some real muppets (as well some fantastic people). However, I have no problem trusting them with my data – and I take data privacy and security very seriously…

Another cliche… power corrupts, and absolute power corrupts absolutely. I tend to land on the side of non-paranoid, but I also consider myself a realist. If a company can increase their own revenue by mining your analytics data, there’s every chance they will.

In this case, the TOS does not explicitly state something like “your data will not be used in any way, in individual or aggregate, by Google to affect any other Google services you pay for” (poorly worded, hopefully you get the point).

I think it comes down to the perception of conflict of interest. A rule of politics… regardless of your intent, don’t ever be in a position where a conflict of interest could be perceived. Same with a single company making the vast majority of their money by selling ads and by selling/giving away a system that monitors said ads.

I’m a web analytics consultant for a variety of small and large analytics packages. The only one I see a conflict of interest in is GA. That doesn’t mean people shouldn’t use it or it is bad, but you can’t just use it and be blissfully ignorant of the potential issues.

Eric: Strong views from a right-winger on this subject (using Ali’s political analogy above). I have to say that I don’t believe in cliche’s. For example “there is no such thing as fa ree lunch” is one that apache, linux, hotmail, wordpress (and more recently spotify) dispelled a long time ago.

A unique feature of the web, is that the competition is only one click away. There is no contract or tie with Google products that forces people to use them. If they did not have good, trust worthy products, Google’s business model would collapse – and rapidly. That’s why there is no conflict of interest for G. On the contrary, fooling with data will lose Google large volumes of Search users and therefore its advertising revenue. I can’t think of a stronger reason not to mess with data.

In terms of the GA TOS, of course Google wishes to improve its services for everyone – advertisers, web site owners and end-users (the web public). It will use any data available in order to improve products and services – isn’t that good business? But that does not mean that they look at an individual GA account – that would be pointless. When you have billions of data points available, why focus in on one? Doing so will drive some very flakey business decisions.

BTW, what about Yahoo Web Analytics?

Growmap (Internet Strategist): We have had this conversation elsewhere, so I am only going to post the one reply to you…

On bank charges/fees – What to one person is an overcharge, to another is a fair fee for a quality service that costs money to produce and jobs to service it. There are two sides to that debate and neither is related to data security or privacy.

I don’t see a conflict of interest – Google’s job (from a search point of view) is to make the user experience so good, people continue to use Google search (or use it more often/recommend it). That way, their search engine is more attractive to advertisers and they therefore make more money.

To keep the user experience high, it must match relevant ads to search queries. So yes, it makes sense to use all data it can to improve its service. And it does this with anonymous, aggregate data.

As with all Google services, if you don’t wish to share your anonymous data with them you can opt out. Though I am not sure why you wouldn’t wish to improve you own user experience.

You are right, the golden days of Adwords are over – more people are aware of it and so there is more competition for ads. Simple bidding strategies no longer cut the mustard, which is why it is now a specialist area of digital marketing.

Interesting that you would use banking as an analogy. Banks would never take advantage of their users by charging unreasonable overdraft charges, ridiculously high late fees, or raising interest rates higher than those of what were once called loan sharks, would they?

Whenever a conflict of interest exists it is wise to consider what the result could be. It would be truly naive to assume that Google will not use all the data at their disposal to increase their earnings.

AdWords was once truly the golden goose for both Google and their advertisers. I wish it still were.

Marcus: LOL – I must admit that as a mortgage owner the words ‘trust’ and ‘banking’ don’t fit very well with me either…

I think what you are referring to is the lack of trust we now all have in senior banking management to invest our money wisely and responsibly.

However the analogy of my post concerned whether your financial details, such as income and expenditure, are kept private and securely. I don’t feel that has changed.

This was posted on the 17th of March 2008 so I think the analogy of ‘trusting’ the bank is particularly apt right now.

No, I do not trust the bank or the banking system. Do you?

Regards

Marcos Richardson

Head of SEO & Analytics

RBI Business Leads Division

Reed Business Information

Daniel/DJ: Thanks for the feedback

Scott, I used to be a hard core SEO’er – that’s how I got into web analytics. I needed to show my clients that what I was doing worked…! There is no detrimental or incremental SEO effect of using GA on your website. Period.

If you could point me to the articles you refer to I will happily check their credibility.

This is a fantastic spin on a hot topic right now in the web analytics world. I believe that how you interpret it is based upon your own makeup. More paranoid types will make comments as Scott Elkin did (above) while more business types will realize that Google understands their higher responsibility which is to “manage the world’s’ information.

Fantastically presented and I agree with your opinion Brian.

What is Google going to do to hurt any company for using their analytics system?

Scott,

I think you are quite wrong. Those “hard core SEO’s” are just like Orthodox people, they will find anything in the book they use.

I like very much the line of work of Maya Bar Hillel when she criticizes the Bible Codes. A quote from her paper, that can be used perfectly in your case, is “their result merely reflects on the choices made in designing their experiment and collecting the data for it.” I would love to receive the “SEO’s” researches and take a look at the methodology and statistical significance.

It is very easy (and cool) to write “they say that Google is evil”, but maybe you should read Brian’s article before. He made some excellent points on why Google would not use our data, and it can be summed to: they don’t need it, they are smart enough to make a fortune without it.

BTW, thanks for the great post Brian, I like the metaphor.

It is silly to think that Google WOULDN’T use any data it has to score your site.

I have read several articles by hard-core SEO’s that have seen penalties by Google, and the only way it could of happened was by the use of their Analytics data.

If you’re smart, you would be wise to not let Google know anything you don’t want it to know.